Futures and options are both derivative instruments, and that simply means that they derive their value from an underlying ProfitiX Broker asset or financial instrument. Both future and options contracts have their very own distinct advantages and disadvantages.

For options, it has an obvious advantage against futures. An option provides the contract buyer the right, but not the obligation, to buy or sell an asset or financial instrument at a fixed price on or before a predetermined future time. What this all means is that the maximum risk to the buyer of an option is limited to the premium that was paid.

However, futures have some very important advantages over options. A futures contract is a binding deal between a buyer or a seller to buy or sell an asset for a financial instrument at a fixed price at a future date that has been set in the present.

Even though futures are not for each and every trader, they do very well for certain investments and certain types of investors.

Futures are great for certain investments.

You can probably say that futures are not the best way to trade stocks, for example, but they are a very good way to trade specific investments like commodities, currencies, and indexes.

Their standardized features and very high levels of leverage make them especially useful for the risk-tolerant retail investor. The high leverage enables those investors to participate in markets to which they may not have had access otherwise.

Fixed Upfront Costs

The margin requirements Profitix Broker Review for key commodity and currency futures are popular because they have been relatively unchanged for years. Margin requirement may be temporarily increased when an asset is quite volatile. However, in most cases, they remain unchanged for a year to the next. In other words, you would know ahead of time how much has to be put up as an initial margin.

On the flip side, the option premium paid by an option buyer can differ largely, depending on the volatility of the underlying asset and broad market. Higher volatility on the underlying or broad market means that the premium that the option buyer will pay will also be higher.

No Time Decay

This is a huge advantage of futures against option. Options are “wasting assets,” which tells us that their value declines over time and this event is also known as time decay. A number of factors affect the time decay of an option.

One of the most important factors is the time to expiration. An options trader has to look out for the time decay, since it can severely diminish the profitability of an option position or turn a winning position into a fabulously losing one.

Futures, on the flip side, do not have to worry about time decay.

Liquidity

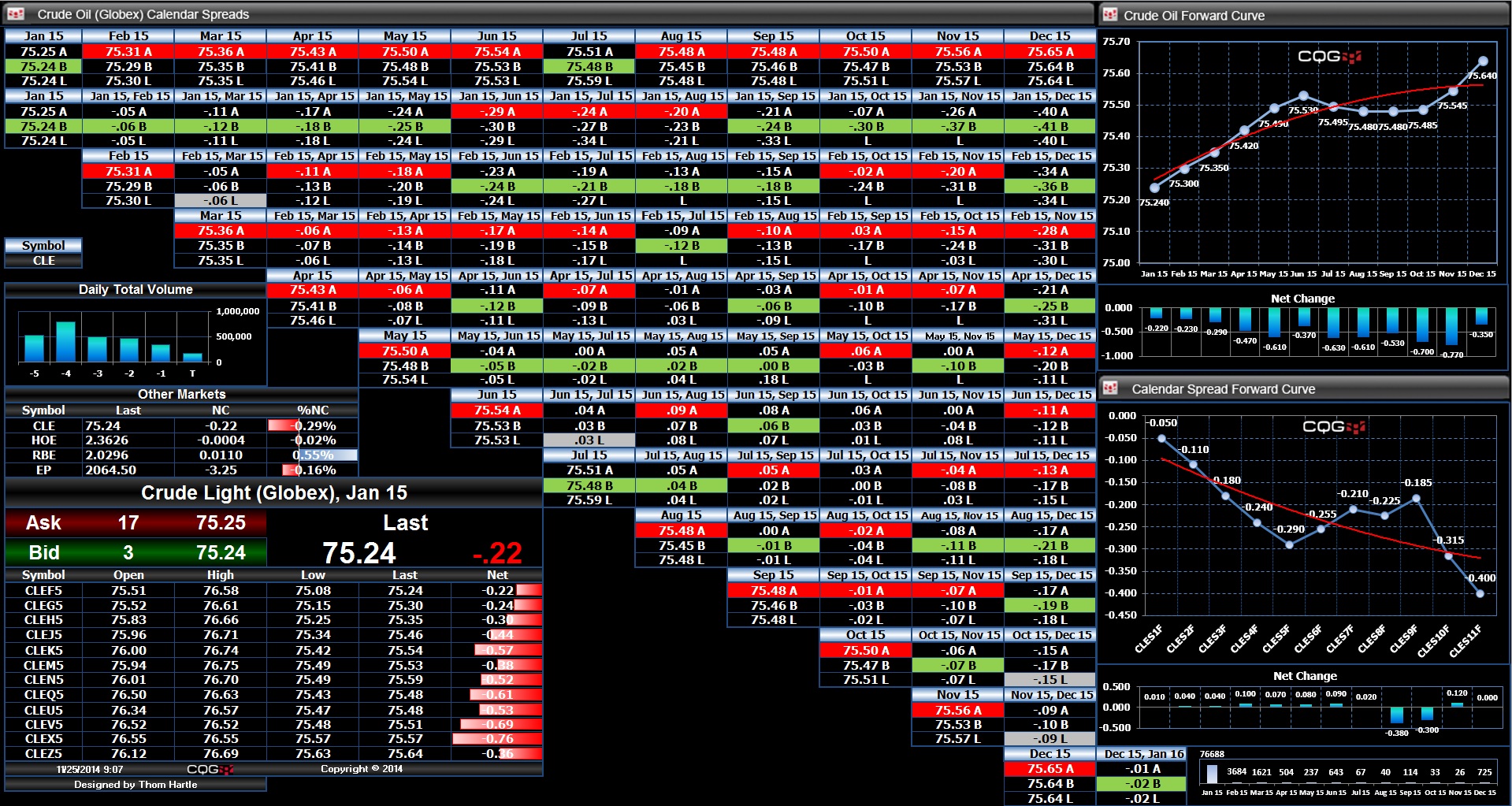

This is another huge advantage of futures over options. Most futures markets are very deep and liquid, especially in the most commonly traded commodities, currencies, and indexes. This give rise to narrow bid-ask spreads and reassures traders they can enter and exit positions when required.

Options, on the other hand, may not always have enough liquidity, particularly for options that are well away from the strike price or expire well into the future.